Analysis of the status quo of the three major markets of China's pipe industry

2021-11-26

Analysis of the status quo of the three major markets of China's pipe industry

Driven by relevant national policies, the domestic plastic pipe industry has shown strong growth in recent years and has become the main force of the domestic plastic processing industry. According to statistics from China Plastics Processing Industry Association, the current annual growth rate of China's plastic pipe market is 15%, ranking first in the world.

However, a good development environment has not made the progress of domestic plastic pipe companies easy. Since 2003, the price of raw materials has risen, and the pressure formed has made companies overwhelmed, especially the price of polyvinyl chloride resin has soared, and some small and medium-sized enterprises with weak strength The company is even more difficult to operate, on the verge of loss, and the company as a whole is facing severe challenges.

Soaring raw material costs soaring

Since 2003, due to the rise in world crude oil prices, the world's plastic raw material market prices have risen across the board. Driven by prices in the international market, domestic prices of polypropylene, polyethylene, and polyvinyl chloride have also been on the rise. Especially for polyvinyl chloride resin, due to the shortage of electricity, the price of chlorine, the main raw material of polyvinyl chloride, has risen tightly, and the price of polyvinyl chloride has risen. Coupled with the victory of the anti-dumping investigation in September 2003, the dual factors have stimulated polychloride. The price of vinyl resin has risen. For PVC pipe companies, the price increase of PVC raw materials alone will increase product costs by more than 20%.

Ban on lead salt makes it worse

In addition to trying to absorb the cost pressure caused by rising raw material prices, PVC pipe companies must also face the ban on lead. Lead salt stabilizer has been used as the main heat stabilizer by domestic PVC pipe manufacturers because of its low price and excellent performance. However, due to environmental considerations, the 2004 construction announcement clearly stated that the water supply CPVC (hard vinyl chloride) pipes used nationwide must be produced with non-lead salt stabilizers. From April 1st, Beijing will restrict the use of PVC drinking water pipes and fittings that use lead salts as stabilizers. The electric power department has decided that all CPVC (chlorinated polyvinyl chloride) power protection pipes within the scope of the Ministry of Electric Power's network access license to prevent environmental pollution, prohibit the use of lead salts and organotin stabilizers. The price of other stabilizers is higher under the premise of ensuring the performance, which invisibly increases the cost burden of pipe companies.

Single species, internal and external troubles

The huge market capacity and low barriers to entry have made plastic pipes a hot spot for domestic investment in the past few years. Due to blind investment at that time and overcapacity of low-end products, its vicious effects have begun to appear. Take the PVC pipe enterprise with the largest market share as an example. At present, its products are still concentrated in urban and rural water supply and drainage pipes and pipe fittings, rainwater drainage pipes and pipe fittings, which has caused its market capacity to become saturated and increased competition in this product field. strength. In order to compete for the market, some companies adopt price-driven strategies, especially small companies dumping inferior products at low prices. The price war has intensified and is in a situation of vicious price competition.

The original competitive advantage of polyvinyl chloride pipe companies with low-tech products and single-variety products is that their prices are lower than those of polyethylene and polypropylene pipes. However, rising raw materials put them in a passive situation and provide an entry point for competitors. In addition to the original gas pipes, heating pipes, etc., the emerging polyethylene pipe market applications have also begun to enter the urban and rural water supply and drainage pipes and pipe fitting markets in recent years. Moreover, the price increase of polyethylene resin is smaller than that of PVC, the production cost pressure is not big, and there is no lead ban, which adds a competitive advantage. It can be said that PVC pipe companies are currently in a situation of internal and external troubles.

Actively adjust to regain the market

Judging from the trend of the world plastics market, the high price of raw materials will continue for a period of time. However, due to its consumption characteristics, plastic pipes have relatively little room for price increase. It is hoped that the price of raw materials will fall, which is a drop in the bucket for solving the operating pressure, and cannot fundamentally get rid of the passive operation situation. Marketing strategies must be adjusted.

First, we must shift from product price competitiveness to brand competitiveness, strengthen our ability to respond to emergencies, and build our own competitive bastion. Various signs indicate that domestic plastic pipe production enterprises have entered an era of meager profit. In order to win sustained and stable development space, enterprises should establish their brand image as soon as possible. Large enterprises can absorb the increase in costs caused by the increase in raw material prices by optimizing their production management capabilities. For small and medium-sized enterprises, it might as well work together to reduce production costs through centralized procurement of raw materials.

The second is to strengthen international trade and expand the world market. Compared with the domestic PVC pipe market situation, domestic plastic pipe products have a price advantage in the international market, are paid more and more attention, and have relatively high profits.

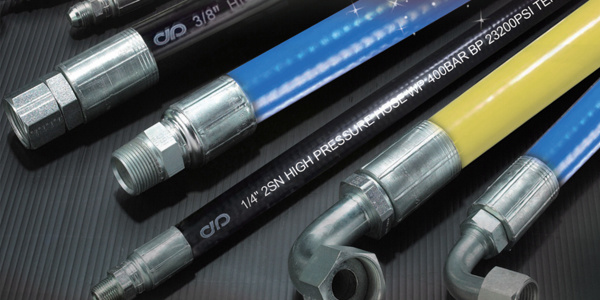

Third, we must increase the development of new products and open up new profit points. Compared with advanced countries, there are still many blank areas in the application of plastic pipes in my country. This is the new market capacity, such as the research and development of plastic cloth hose products. At present, the production of domestic plastic pipe companies is mainly concentrated on plastic hard pipes, and relatively few companies are involved in the production of plastic hoses. Therefore, the market is relatively broad, especially for high-tech hoses, which have few competitors and high product profit margins. .

The fourth is to enhance marketing innovation capabilities. In the past, domestic plastic pipe companies mostly adopted the marketing and promotion strategies of industrial products. In fact, in terms of the essential characteristics of plastic cloth pipe products, some plastic pipes, especially civilian products, may wish to adopt consumer product marketing and promotion strategies to establish brand names. As far as the current sales channels of domestic plastic pipe companies are concerned, network construction should be accelerated and the promotion of market terminals should be strengthened, such as cooperation with large-scale building materials supermarkets.

4. The export situation to the European market has improved

In terms of exports, the growth rate of exports to the top five trading partners is quite different. Specifically, exports to Hong Kong are US$14.4 billion, a decrease of 27.1%; exports to the United States are US$10.9 billion, a decrease of 2.6%; exports to Japan are US$5 billion, an increase of 18.7 %; exports to South Korea were US$4.2 billion, a decrease of 1.4%; exports to the Netherlands were US$3.2 billion, an increase of 4.1%. Exports to some emerging markets maintained rapid growth, such as India, Brazil, Russia, and the Philippines, where the growth rates reached 18.7%, 27.4%, 40.4%, and 53.4%, respectively. The export situation to the European market has improved and the weak situation in the past two years has been reversed. The export value was US$11.8 billion, a year-on-year increase of 10.7%. From the perspective of major countries, exports to Germany, the United Kingdom and France increased by 20.1%, 29.9% and 29.9% respectively. 17.1%.

In terms of imports, re-imports ranked first, with imports of 9 billion U.S. dollars, a decrease of 19.5%. The next five countries and regions were South Korea (8.6 billion U.S. dollars, 4.5%) and Taiwan of China (7.7 billion U.S. dollars, -18.1%). , Japan (4.1 billion U.S. dollars, 0.5%), Malaysia (2.8 billion U.S. dollars, -2.7%) and the United States (2.2 billion U.S. dollars, 1.6%).

5. The growth trend of import and export of major provinces and cities is different

In terms of exports, the five provinces and cities of Guangdong, Jiangsu, Shanghai, Chongqing and Zhejiang ranked in the top five, with exports of 253, 109, 83, 23 and 2.3 billion US dollars, a year-on-year increase of -15.0%, 5.2%, -1.6%, and 58.8 % And 14.8%. The exports of central and western provinces such as Anhui and Shaanxi have grown rapidly, with growth rates of 90.5% and 69.9% respectively.

In terms of imports, the five provinces and cities of Guangdong, Jiangsu, Shanghai, Shaanxi and Tianjin ranked in the top five, with imports of 160, 64, 61, 2.0 and 1.5 billion US dollars, a year-on-year increase of -26.1%, -0.5%, -2.7%, 454.3% and -0.3%

Recommended News

Guangzhou Depu Rubber Products Co., Ltd

Contact Number

Company Address

168 Industrial Park, floor 1, building B, No. 168, Yingbin Road West, Huadu District, Guangzhou